land speculation

Half of Western Sydney foodbowl land may have been lost to development in just 10 years - Article by Nicky Morrison and Awais Piracha

More and more farming land is being lost to other land uses such as housing on the outskirts of our cities. But how much land is being lost? And why does it matter?

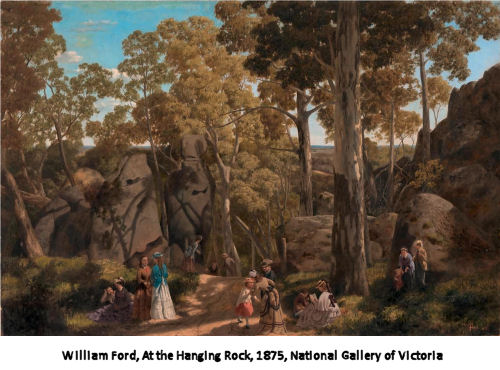

Vic State Planning thumbs nose at Victorians as it condemns Macedon Ranges to 50 yrs of developer rule

This disgraceful rebadged “Statement of Planning Policy” for Macedon Ranges (home of Hanging Rock) sets a damaging growth plan in concrete as State policy for Macedon Ranges for the next 50 years, perpetuating the direction of our previous council (and apparently the State government), not the new direction taken by the new councillors.

This disgraceful rebadged “Statement of Planning Policy” for Macedon Ranges (home of Hanging Rock) sets a damaging growth plan in concrete as State policy for Macedon Ranges for the next 50 years, perpetuating the direction of our previous council (and apparently the State government), not the new direction taken by the new councillors.

The fatally flawed “Statement of Planning Policy” for Macedon Ranges is now available as Attachment 5 to the Special Council meeting agenda for Thursday 13th September, available from Macedon Ranges Shire Council’s website. http://www.mrsc.vic.gov.au/About-Council/Our-Council/Meeting-Dates-Agendas-Minutes/Council-Meeting-Agendas-Minutes/Minutes-Agendas

The officer’s recommendation is that council receive (not endorse) the document; makes it clear the document is a creature of the State government; and makes suggestions for some changes. These include requesting Ministerial Guidelines to give direction on how the Statement is to be implemented, because despite recommendations and requirements that the document itself include this fundamental component, it doesn’t.

Minor changes since January simply reshuffle the deckchairs. The gross deficiencies of the original Localised Planning Statement (now re-badged as a Statement of Planning Policy) remain. It’s still a growth plan, it still doesn’t implement the recommendations of the Macedon Ranges Protection Advisory Committee, and – unbelievably – still doesn’t connect with or implement the Distinctive Areas and Landscapes legislation.

So, other than temporarily moving the settlement boundary back to the existing town boundary at Woodend, nothing you or apparently councillors or officers have said has made any difference.

The new (so-called) “Statement of Planning Policy”:

· Doesn’t make policy statements about how things will be done but a series of weak objectives and strategies about how it is hoped things might be done.

· Instead of being based on Statement of Planning Policy No. 8, condemns SPP8 to oblivion. With it goes justification for current planning controls, including protection of township character (which isn’t a “must” in the new Statement), and no further subdivision at Macedon and Mount Macedon.

Still ignores Macedon Ranges Protection Advisory Committee’s recommendations both for preparation of a statement, and policy e.g. “Landscape, biodiversity, cultural heritage and township protection must be a cornerstone of policy protection for the Macedon Ranges. The conservation of the Shire’s landscapes is of critical importance.” Not there.

· Where absolute clarity is demanded it nails nothing down, increasing uncertainty with “encourage”, “discourage”, “aim to”, “voluntary”, “should”, “consider”, “manage”, while “must” is confined to protection of extractive industries.

· Maintains separate policy domains, without saying how all of these work together.

· Is still not binding on public entities (including council), and only requires these bodies to have regard to the Statement, where relevant.

· Still singles out only “significant”, “State” “National” “high value” and “features” as important.

· Promotes extractive industries (making Macedon Ranges a target for them), and still promotes equine and intensive agriculture.

· Forgets to include almost half of the Shire’s drinking water catchments, and still makes biodiversity dependent on a website address.

Provides absolutely no guidance about dwellings or other development in rural areas, or in towns.

· Is still a growth plan that ignores the Distinctive Areas and Landscapes legislation and sets expanded settlement boundaries without parliament’s approval.

· Only provides Woodend with a temporary reprieve by excluding its investigation areas but continues to give a ‘free kick’ to development interests in other towns by including their investigation areas.

· Still doesn’t include settlement boundaries for Gisborne and Romsey.

· Elevates Kyneton to a “Regional Centre” (10,000+ population) and falsely attributes this to the Macedon Ranges Settlement Strategy when the State government is making it so.

Is based on the Loddon Mallee South Regional Growth Plan, current incomplete Macedon Ranges planning scheme and the appalling draft Visitor Economy document.

Includes the previous council’s deplorable In The Rural Living Zone document (the one based on advice from real estate interests) as a reference document AND requires its on-going implementation, including converting high quality agi soils at Romsey and Farming zone at Kyneton into 2ha blocks.

This disgraceful rebadged “Statement of Planning Policy” sets these weak, vague aspirations and a damaging growth plan in concrete as State policy for Macedon Ranges for the next 50 years, perpetuating the direction of our previous council (and apparently the State government), not the new direction taken by the new councillors.

It’s NOT protection in any guise. It takes Macedon Ranges in the opposite direction to protection and Statement of Planning Policy No. 8 (our existing Statement of Planning Policy), and will have a catastrophic effect on the Shire and its values. It could only be considered an “improvement” over the January Localised Planning Statement if going from bottom of the class to equal bottom is considered an improvement.

Please email your support and encouragement to Macedon Ranges Councillors to not endorse this Statement, and/or attend the special council meeting at Gisborne Shire Offices next Thursday, 7.00pm.

[email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected]; [email protected];

And let this be a lesson and warning to any other areas in Victoria that want to become ‘declared areas’.

Royal Park (a poem by David Parrish)

A tale of three cities - and there's a sting in the tail

"This proposal by Ms Turnbull is just a diversion, an absurdity not worthy of being called a thimble and pea trick, but the agenda behind her smokescreen is worth examining. The GSC is a body set up by premier Baird who, you will recall, had been elected in 2011 on a platform of getting rid of what was undoubtedly the unaccountable and corrupt planning regime of the Labor government. But Premier Baird's promises of returning planning to the community and the councils was soon forgotten and his new government launched reforms that bypassed all community input. These proved to be so unpopular with the public that they were withdrawn and, instead, Premier Baird introduced the GSC, which essentially did the same thing."

"This proposal by Ms Turnbull is just a diversion, an absurdity not worthy of being called a thimble and pea trick, but the agenda behind her smokescreen is worth examining. The GSC is a body set up by premier Baird who, you will recall, had been elected in 2011 on a platform of getting rid of what was undoubtedly the unaccountable and corrupt planning regime of the Labor government. But Premier Baird's promises of returning planning to the community and the councils was soon forgotten and his new government launched reforms that bypassed all community input. These proved to be so unpopular with the public that they were withdrawn and, instead, Premier Baird introduced the GSC, which essentially did the same thing."

Lucy Turnbull is the Chief Commissioner of the Greater Sydney Commission (GSC), and in this role is promoting the idea of “re-imagining" Sydney as three great separate cities - Eastern Harbour City, the Central Parramatta River City, and the Western City in and around the new airport at Badgerys Creek. These smaller cities will, according to Ms Turnbull, be able (in 40 or so years) to meet an essential criteria for a liveable city - the 30 minute transport target where residents can travel to work in half an hour or less. She went on to say that it was essential to embrace the three-cities approach to deal with Sydney's expected population growth. "There's around 4.6 million people living in Sydney now, by 2036, it's expected that number will be more like 6.2 million, and in another 20 years it will be up to eight million." See Michael Bleby and Su-Lin Tan, “Lucy Turnbull’s Grand Plan for Sydney, Australian Financial Review, November 20, 2016.” www.afr.com/real-estate/lucy-turnbulls-grand-plan-for-sydney-20161118-gss887 [Editor: This address is not linked because it lacks the https prefix.]

Sydney does have a major problem with transport – its now ranked 51st out of 100 cities in terms of ease of travel . Congestion cost Sydney $16.5b in 2015 and its been growing every year largely because of increased car numbers. But to suggest that dividing the city into 3 separate identities will somehow mean people will travel less or faster is an absurdity. People commuting to the city centre from Baulkham Hills, Beecroft or Carlingford will still travel the same distance and face the same delays despite having their home address changed to Parramatta River City. And by the same token this name change won't create more employment in Parramatta or western Sydney. Fixing Sydney's transport is almost entirely dependent on providing massive amounts of infrastructure for public transport and has nothing to do with name changing. If previous governments could not do that when the population was 4 million then they certainly won't be able to do it if the population doubles.

The GSC should be aware that retrofitting infrastructure is hugely expensive and disruptive as shown by the unpopular WestConnex which Ms Turnbull described in 2014 as a “necessary evil”. While there are many who would agree that it is evil - the National Trust described the destruction as the “worst hit to heritage” in Sydney’s history and 12,000 submissions from residents as well as 5 councils opposed the project. (These councils were subsequently replaced by forced amalgamations while demolitions were underway.) In 2015 the project was costed at $16.8b but new estimates suggest that it could rise to $45.3b (including $650m so far spent just on legal battles associated with land acquisition) leaving NSW with an impossible debt that will beggar the state for decades curtailing expenditure on other essential projects such as the need to almost double the number of schools & hospitals.

While this scheme may sound a bit like a plot that was rejected by the script writers of the ABC's Utopia it did not receive much in the way of critical analysis. In fact there was even some faint praise because the proposals did mention the importance of cycling, its commitment to women's needs (more street lighting, ramps for prams and footpaths without pot holes) and even gave a slightly bizarre claim to connecting with indigenous history. If you Google “Greater Sydney Commission Plans for Sydney” you will see some inputs that - like the Telegraph -¬ just repeat the governments press release, trumpeting the joys of Jobs & Growth. But there are precious few questioning the validity of the plan let alone the need for population growth - the exception from MacroBusiness. See https://www.macrobusiness.com.au/2017/08/heres-lucy-turnbull-can-fix-sydney/

However there is more than just Sydney's congestion to consider. For instance the planned population growth will require the construction of 725,000 new dwellings along with 817,000 new jobs at a time when employment is threatened by technological changes. There will also need to be a matching increase in our capacity to handle waste and supply water yet we have governments that allow mining under Sydney' water catchment and won't apply even the mildest restrictions on plastic usage. Developer-related corruption is rife, yet the NSW government cut ICAC [Independent Commission against corruption] funding in half and the federals won't even consider having such a commission. Ms Turnbull claims that Sydney is not full and we need to grow to become a “World City”. Well we could argue that Mumbai or Jakarta also aren't full but most of us would consider the European capital, Brussels at 1 million more liveable than Beijing with its population of over 20 million.

This proposal by Ms Turnbull is just a diversion, an absurdity not worthy of being called a thimble and pea trick,[1] but the agenda behind her smokescreen is worth examining. The GSC is a body set up by premier Baird who, you will recall, had been elected in 2011 on a platform of getting rid of what was undoubtedly the unaccountable and corrupt planning regime of the Labor government. But Premier Baird's promises of returning planning to the community and the councils was soon forgotten and his new government launched reforms that bypassed all community input. These proved to be so unpopular with the public that they were withdrawn and, instead, Premier Baird introduced the GSC, which essentially did the same thing. This is a common tactic of governments. The GSC is but one of a number of unloved bodies, like Urban Growth and the Hunter Development Corporation, that can carry out the dirty work while isolating the government from the responsibility of any unpleasantness. Even more importantly the government can dictate the charter of these agencies, in this case limiting their role to planning for population growth without the need to consider adverse consequences. As an example NSW and Queensland recently removed sea level rise from their state planning policies and the former Labor governments sea level planning benchmarks, based on the Intergovernmental Panel on Climate Change data, were rejected, and decisions left to local councils. More than $226 billion in Australian commercial, residential, rail, road and industrial assets is at risk from climate change-induced sea-level rise with close to 250,000 residential properties and 8600 commercial buildings vulnerable, as well as ports, power stations, hospitals, and water and waste facilities. See https://www.thefifthestate.com.au/tag/planning-2

It is hardly likely that Ms Turnbull or anyone in the SGC is a climate sceptic, yet they feel no compulsion to listen to warnings from the Climate Council. None of the media outlets – Fairfax, News, or the ABC - felt it necessary to point out that bigger cities are hotter and more prone to damage from severe storms or even that developer-related corruption has become endemic and might be influencing these decisions. Nor did they mention that Sydney's expansion will come at the expense of its green spaces, air quality, and even its food bowl, which provides the bulk of its fresh food production. See https://theconversation.com/urban-sprawl-is-threatening-sydneys-foodbowl-55156

It seems that all those involved in city planning have restricted their activities to searching for land that can be acquired from fortuitously defunct industrial sites or older dwellings – even schools - that can be replaced with high rise. No one seems to heed warnings from the science community on the threats from increased storm intensity, even though at its current size Sydney will be unable to withstand the adverse effects of climate change. Such is the way civilizations have collapsed in the past. Ideology is no substitute for science.

NOTES

[1] ‘Thimble and pea trick’: The shell game (also known as thimblerig, three shells and a pea, the old army game) is portrayed as a gambling game, but in reality, when a wager for money is made, it is almost always a confidencetrick used to perpetrate fraud. (Wikipedia)

20 July 10am Meeting to save Victoria Market from Council micro-management

Victoria Market, as we know it, is under threat. The City of Melbourne, along with the top end of town, has plans to reduce and gentrify our historic market, paying lip service only to its valued heritage and the important service it provides to the wider Melbourne community, in particular, its role in keeping food quality standards high, food prices down, while providing astounding diversity.

Victoria Market, as we know it, is under threat. The City of Melbourne, along with the top end of town, has plans to reduce and gentrify our historic market, paying lip service only to its valued heritage and the important service it provides to the wider Melbourne community, in particular, its role in keeping food quality standards high, food prices down, while providing astounding diversity.

The Council’s intention is to:

sell off part of the market’s land for commercial development, road extension and other purposes

to build high-rise buildings at its immediate doorstep,creating tall walls and corridors around its perimeter

to shrink the market from 12 sheds to 5

to gentrify this historical market by cherry picking which traders will stay or go,

jeopardise &/or close small, family-run businesses by not renewing or extending leases beyond one year,

to create a gourmet food precinct and entertainment space.

In short the Council proposes to micro-manage a cultural change of the market, to change its size and shape and give itself free rein to make physical changes to its layout without further public consultation.

Dear Protectors of Public Lands Victoria Inc. members and friends

Here is a message from the Friends of the Queen Victoria Market. (PPL VIC is a great supporter) "You are invited to a meeting which is about building a community campaign with market traders, its customers, the wider community and the NUW (National Union of Workers) to protect the Vic Market, its people and its history. See https://www.facebook.com/FriendsofQueenVictoriaMarket. where you will find the flier and good background on the issues. The Friends of QVM Facebook page is a community page and everyone who is interested is welcome."

Meeting details are:

Date & time: Wednesday 20 July at 10.30am

Venue: Victorian Trades Hall Council Chambers, Cnr Lygon and Victoria Streets, Carlton

Location: Melways ref: Map 2B F12, Trams along Victoria and Swanston Sts, Buses along Lygon & Swanston Streets

Contact: Mary-Lou Howie M 0401 811 893

Facebook:https://www.facebook.com/FriendsofQueenVictoriaMarket

The message from Friends of QVM continues: Just in case you don’t follow the Friends of Queen Victoria Market Facebook page which I co- author and now has a huge following, the Vic Market traders and supporters are having a big meeting at Trades Hall this Wednesday at 10:30 am.

As you must be aware, the Vic Market, as we know it, is under threat. The City of Melbourne, along with the top end of town, has plans to reduce and gentrify our historic market, paying lip service only to its valued heritage and the important service it provides to the wider Melbourne community, in particular, its role in keeping food quality standards high, food prices down, while providing astounding diversity.

The Council’s intention is to:

sell off part of the market’s land for commercial development, road extension and other purposes

to build high-rise buildings at its immediate doorstep,creating tall walls and corridors around its perimeter

to shrink the market from 12 sheds to 5

to gentrify this historical market by cherry picking which traders will stay or go,

jeopardise &/or close small, family-run businesses by not renewing or extending leases beyond one year,

to create a gourmet food precinct and entertainment space.

In short the Council proposes to micro-manage a cultural change of the market, to change its size and shape and give itself free rein to make physical changes to its layout without further public consultation.

The Lord Mayor has said this is the largest project ever undertaken by the City of Melbourne and an implementation strategy is now in place, yet no comprehensive plans detailing what is to be implemented has ever been revealed to the public.

Friends of Queen Victoria Market have a healthy readership of around 2,000 - 5,000+ people who want the market to continue as a sustainable, functioning shopping space for all people in Melbourne. We support revitalisation of the market and believe in proper independent consultation that leads to appropriate change, always mindful of QVM’s history, heritage and importance to our community.

If you are available, I would love to see you at Trades Hall on Wednesday. Cheers, Mary-Lou Howie M: 0401 811 893

Circulated by Julianne Bell Secretary Protectors of Public Lands Victoria Inc.PO Box 197 Parkville 3052 Mobile 0408022408

Things are no longer quiet around Highett

Here cdb poet, Brolga-Brolga, tells a moral tale of how a number of neighbours clubbed together to speculate on their adjacent land, but when they tried to buy again, they were already priced out of the market. With homage to Barry Humpreys who wrote The Highett Waltz, sung by Dame Edna, and linked to here.

Here cdb poet, Brolga-Brolga, tells a moral tale of how a number of neighbours clubbed together to speculate on their adjacent land, but when they tried to buy again, they were already priced out of the market. With homage to Barry Humpreys who wrote The Highett Waltz, sung by Dame Edna, and linked to here.

The pressure is on in our quiet locations

The people who come here are not on vacations

They’re here to stay or so they believe it

The traffic’s horrendous no laws can relieve it

Our peaceful suburbs are in constant disruption

As developers demolish and dig deep for construction

The roads are adorned with red tape and “no access”

Impeding our progress with no sign of success.

Because all the hordes buy our houses galore

One group of people saw their chance to the fore

They got together all 8 neighbours next door

And conjured a sale, a bonanza for all

With planning awry it was well worth a try

To ruin the street but escape with their prize

A premium was paid for these 8 in a row

But for the old friends and neighbours ‘twas a terrible blow

The 8 Bay Road vendors raced away with their gains

And searched the bay suburbs, taking great pains

To find houses in line with their new found riches ,

With sun-decking, en- suites and brand new kitchens

Alas and alack they found only thin pickings

The houses all small and in very poor settings

As month after month they searched the “for sales”

The prices raced right past their premium gains

Meanwhile back in Bay Road, the 8 modest houses

Lie in ruins amid the remains of their gardens

They will be replaced with a 6 storey building,

of 50 apartments, the council unyielding

To grief stricken neighbours, their lives all in tatters

And the council kept saying "what on Earth does it matter?"

So, it’s no longer just normal and quiet ‘round Highett,

It’s constant construction, you just cannot fight it

The neighbours who stayed in Bay Road are defeated

Some internal peace needs be created.

But there will be no peace with those who absconded

and left them the mess to which they are now bonded

These 8 made so little in real estate terms

It’s a hard lesson and one we should learn.

With high immigration the prices will rise

and your fat sum of 1 million will soon take a dive

"Oh only a million, you might try a flat .."

Forget house and garden say "bye- bye to that."

The irony of the Vietnam War versus the Australian Property Bubble

The Vietnam War led by the US spanned most of the 1960s through to 1975. The famous motto “All the way with LBJ” developed as a result of Australian PM Harold Holt’s commitment to military support of the US led War in collaboration with Lyndon Baines Johnson, the US President.

The Vietnam War led by the US spanned most of the 1960s through to 1975. The famous motto “All the way with LBJ” developed as a result of Australian PM Harold Holt’s commitment to military support of the US led War in collaboration with Lyndon Baines Johnson, the US President.

The conventional political wisdom at the time was that the North Vietnamese “Commos” were simply part of a larger Communist “Empire” led by Mao Tse Tung; the Chinese Communist revolutionary and founding father of the People's Republic of China, which he governed as Chairman of the Communist Party of China from its establishment in 1949 until his death in 1976.

The War was controversial and based partly on something called the “Domino Theory”, which meant that Australia was exposed to the threat of invasion by the Communist Chinese. Once the Commos took South Vietnam we were done for.

Today Australia faces the irony of an “invasion” by the Capitalist Chinese. Their money is invading Australia.

They are buying houses and farms in order to exploit opportunities for profit, including removal of food from Australia. We have empty houses throughout the suburbs of capital cities that may have been purchased to diversify some foreigner's asset portfolio.

They are buying houses and farms in order to exploit opportunities for profit, including removal of food from Australia. We have empty houses throughout the suburbs of capital cities that may have been purchased to diversify some foreigner's asset portfolio.

Australia’s politicians, supported by the ABC, provide the Australian people with no reasonable option by way of public policy debate. The ABC just reports what is happening instead of challenging the logic.

It’s all about the wealthiest lobbying for “growth”. People like Paul Keating were praised for “deregulating” the Australian economy in the early 90s and cutting down tariff barriers. The Liberals fully supported these theories.

In 2000, with the Australian Dollar at around 50 US cents, the import duty on foreign cars was around 5%. By 2008 the Australian dollar had risen to around 95 US cents. Similar rises had also occurred against all major currencies. In order to maintain the competitiveness of the Australian car industry at a level comparable to year 2000, the tariff would have needed to rise to 78%, because US Dollar priced cars had become so much more competitive.

This was free trade (?) combined with a rigid tariff structure that ignored the integral part that the exchange rate played in defining competitiveness. What drove the Australian dollar so high? Surely this was a combination of factors driven by Government policies including:

- Extreme population growth driven by mass migration

- The population policy driving demand for everything, including housing

- The population policy creating a dilemma for the Reserve Bank’s interest rate policy. There is a conflict between the need to use high interest rates to resist house price inflation and the need to reduce Australia’s exchange rate using low interest rates. The Government and Reserve Bank have failed miserably in achieving a coherent outcome. Some of the blame must surely be attributable to the extreme population growth policy

- The FIRB’s failure to manage the impact of foreign investment on the long term "interests" of the Australian people by supporting foreign investment in all its forms

- The delusionary thinking that convinces both economists and politicians that GDP growth must be driven by population growth despite all the KPI’s that suggest that this may not be true. These include adverse trends in unemployment, homelessness, productivity, infrastructure funding, Federal budget growth, GDP growth per capita, and environmental impact. In fact there is arguably not a single KPI that clearly supports extreme population growth

So what is driving extreme population growth? It’s really quite simple. Politicians are addicted to dumb GDP growth and fail to perform the due diligence analysis of the facts that might lead to a better understanding of the extreme population growth problem in Australia.

The ABC fully supports this failure by claiming the issue is “not newsworthy”.

Big business loves it because it drives short term profits. No other criterion is substantially or actively used to drive the decision-making of big business.

If the Government can neither evaluate nor comprehend what is in the national interest; what hope is there for Australia's future?

Prices rise to absorb increases in income - Article by John Kosy

|

Here is a story that explains this concept. Thanks to our contributor, Matthew Mitchell, for alerting us to this brilliantly simple analysis of our current problem, originally published as a comment here. It is a skilled, yet easy to understand, critique of economic theory that underpins todays political policy and the similar adverse impact of globalisation on places as far away from each other as Bangladesh and Australia. |

(Original Source by John Kozy, Global Research, February 13, 2012: http://www.globalresearch.ca/abstractions-versus-the-real-world-economic-models-and-the-apologetics-of-greed/29270 Subtitles inserted by candobetter.net editor.

(Original Source by John Kozy, Global Research, February 13, 2012: http://www.globalresearch.ca/abstractions-versus-the-real-world-economic-models-and-the-apologetics-of-greed/29270 Subtitles inserted by candobetter.net editor.

"Offshoring production to underdeveloped nations gives needy people jobs, increases their incomes, reduces poverty, and expands their nations’ GNPs. It also enables people in developed nations to purchase products produced offshore at lower prices enabling them to consume a wider range of things. As a result, everyone everywhere is better off."

Convinced? Most economists are, but it hasn’t worked that way. Everyone everywhere is not better off—as the whole world now knows. Why?

A factory in Bangladesh

In the latter part of the 80s or early part of the 90s, a large retailer (don’t remember which one) thought it would be a good idea to bring an employee of a factory in Bangladesh to America to see how the clothing the factory was producing was being marketed to Americans. So a Bengali woman was selected to represent her factory and brought to America. This idea didn’t work out well. The woman not only saw how the products were being marketed but how much they cost and she was infuriated. She knew what she and her coworkers were being paid, about two percent of the price of the garments. She did not remain silent and was quickly sent back to Bangladesh. Here is the gist of her story:

She said she and her coworkers were not financially better off after being hired by the factory. Yes, the wages were better than those that could have been earned before, but they weren’t much benefit. Why? Because when the paychecks began to arrive, the local landlords and vendors increased prices on everything, so just as before, all of their incomes went to pay for basic necessities. The landlords and vendors got the money; the workers were not better off, and those in the community who were not employed by the apparel factory were decidedly worse off. It fact, it quickly became apparent that the workers were working for nothing. They did the work; the landlords and vendors got the pay. But, of course, the country’s GNP was better, which is all that matters to economists who still claim that Bangladesh’s economy is improving.

And although Americans were able to buy the apparel more cheaply than they could have before the manufacturing was offshored, the American apparel workers who lost their jobs are decidedly not better off.

Two conclusions follow from this scenario: employment alone is not a sufficient condition for prosperity; full employment can exist in an enslaved society along side abject poverty, and an increasing GNP does not mean that an economy is getting better. Remember these the next time the unemployment rate and GNP numbers are cited. Those numbers mean nothing.

"The economic model described above just does not work, not in Bangladesh or anywhere else"

More than thirty years has now passed and nothing has changed in Bangladesh. Most Bengalis still continue to live on subsistence farming in rural villages. Despite a dramatic increase in foreign investment, a high poverty rate prevails. Observers attribute it to the rising prices of essentials. The economic model described above just does not work, not in Bangladesh or anywhere else. Explaining why reveals what’s wrong with economics and why current economic practices, which have not essentially improved mankind’s lot over the last two and a half centuries, won’t ever improve it.

Economists build models by what they call “abstraction.” But it’s really subtraction. They look at a real world situation and subtract from it the characteristics they deem unessential. The result is a bare bones description consisting of what economists deem economically essential. Everything that is discarded (not taken into consideration in the model) is called an “externality.” So the models only work when the externalities that were in effect before the models are implemented do not change afterward."

A Symbiosis Of Corruption And Ecological Destruction: Deforestation in Sarawak And Empire-Building In Ontario

Too often we fail to see the connection between the ecological destruction and cultural genocide of so-called "developing" nations and the lax immigration policies of those nations like Canada which play host to both the victims and the perpetrators of the tragedy. A look at the relationship between Sarawak's plight and the inflation of real estate values in Ontario, Canada and elsewhere should give us a better understanding of how plunder abroad promotes in-migration here. Canada, by offering an outlet to dirty money and the people who profit from it, must be seen as a willing accomplice and silent partner to a vast money-laundering operation.

Too often we fail to see the connection between the ecological destruction and cultural genocide of so-called "developing" nations and the lax immigration policies of those nations like Canada which play host to both the victims and the perpetrators of the tragedy. A look at the relationship between Sarawak's plight and the inflation of real estate values in Ontario, Canada and elsewhere should give us a better understanding of how plunder abroad promotes in-migration here. Canada, by offering an outlet to dirty money and the people who profit from it, must be seen as a willing accomplice and silent partner to a vast money-laundering operation.

Introducing The Godfather of Sarawak

I had a friend, "David", over for 3 hours this past Wednesday night. David, a serious Christian, and an individual of outstanding character, was a CUSO worker in Sarawak four decades ago and returned for a three month visit this winter to re-connect with old friends. Upon his return he treated me to a travelogue more enlightening and thorough than anything you would find on National Geographic program. Among his major concerns was the alarming growth of the Islamic population which is being favored by the patronage of the province's corrupt Minister, and the ominous potential that demographic shift might have for the liberty and security of non-Muslims. Coincidentally, two weeks after listening to David's account and seeing hundreds of his beautifully graphic pictures, I came upon a television documentary about the politics of this region, and invited David to view the recording. It was the 20 minute documentary that Global TV did on the Chief Minister of Sarawak, Abdul Taib Mahmood, and his kleptocracy. David confirmed the truth of most of what was said in the documentary, and was very pleased that two environmental activists in London, England were following the labyrinthine money trail from "Daddy" to his daughter Jamilah Taib Murray, the wife of Canadian Sean Patrick Murray.

The Criminal Rape Of Sarawak’s Rainforest

I was able, in the second viewing, to record several fascinating facts about Jamilah and Sean Murray's real estate investments in Canada, which ironically began in Ottawa. What I found ironic is that Ontario's 'green' Premier Dalton McGuinty, darling of David Suzuki, leads a government with 11 Ministries who pay $4.9 million a year in rent to the Murrays for office space in their building(s). The Murrays---through their "Sakto Corporation"---- own six major commercial properties in Ontario worth over $100 million , money which has its origin in the criminal rape of Sarawak's rain forest and its conversion to palm oil plantations. This is a catastrophe of global significance. One square mile of Sarawak's rainforest contains more biodiversity than all of North America. More than that, in clearing cutting an area the size of England, the logging companies---owned by Taib's family and their political allies (largely ethnic Chinese)----they have obliterated the culture of the Penan people, one of the last nomadic tribes in the world. Many Penan protesters have been overtly killed or have simply disappeared. One of them, now a Canadian resident, spent a month in solitary confinement just for participating in a blockade to stop logging trucks. He walks the streets of a Canadian suburb like a disembodied and broken spirit, stalked by memories of a life spent in a tropical heaven, a heaven that is now rapidly being transformed into hell. As he spoke to the camera, his face was concealed in darkness---a testimony to the ability of Sarawak's "mob boss" to intimidate even the people who, one would think, should be beyond his grasp.

Corruption in Sarawak Finances Real Estate Development Abroad

As the logging has proceeded, the Taib family has grow richer and richer. At least 84% of the shares of Cahya Mata Sarawak (CMS) , a Sarawak-based construction conglomerate with net assets of $760 million (US) are held by Taib’s late wife and his four children Mahmuc Abu Bekir Taib, Sulaiman Rahman Taib, Hanifah Taib and Jamilah. According to Malaysia’s Anti-Corruption Commission, CMS ,“has a track record of receiving untendered public contracts worth millions of dollars and holds a cement monopoly in Malaysia’s largest state...and has also massively benefited from the Bakun dam construction which has been labelled by Transparency International as a ‘monument of corruption’”. A CMS subsidiary “Similajau Industries” has also formed a connection with Rio Tinto Alcan to oversee the an aluminum smelter with the scope to produce up to 1.5 million tons per year.

When Jamilah was a foreign student in Canada in 1983, Daddy the Godfather and Piggy Bank, gave her $23 million to play with, and so began her real estate acquisitions in Ottawa, now extended to America, Britain and elsewhere. In fact the British government is currently looking into alleged Taib family money-laundering in the UK and British offshore financial centres. Through “Ridgeford Properties”, Sean and Jamilah Taib Murray hold luxury properties in Central London estimated to be worth several hundred million pounds. Jamilah is also currently a Director on the boards of some 63 Malaysian companies.

Canada The Land Of Opportunity And The Champion Of Diversity

It warms the heart—doesn’t it---to know that it was Canada, the land of opportunity, which allowed this enterprising immigrant to launch a business empire stretching almost across the globe, fuelled by monies obtained by crony capitalism and the wanton destruction in a faraway tropical land, home to so much biological and human diversity. How ironic that diversity can be destroyed in Sarawak to feed real estate development in a country that brags about its “diversity”.

Dalton McGuinty too can take pride in helping her to grow her business and reward Minister Taib for his program of relentless rainforest destruction. Whatever initiatives McGuinty has taken to reduce carbon emissions in Ontario have been more than offset by the deforestation that has enabled Jamilah to build her empire. With the destruction of this magnificent jungle, the world is not only losing a unique culture, and untold species---including the orangutan---but a carbon sink of similar scope to the Amazonian forest. And Canada, it seems, must make itself a haven for refugees fleeing from these kinds of tragedies, but for the perpetrators and their ill-gotten gains as well. Is this an effective remedy for a problem that is all too common in the "developing" world? In many ways, Sarawak is a microcosm of the world. Greed, corruption, economic disparity, religious friction, environmental degradation and the displacement of indigenous peoples---it is all in play. Perhaps we can attack the problem in another way. A way that would assist both Canada and those who we would want to protect from persecution. Rather than open the door to untold millions of refugees, maybe we should slam the door to the forces of greed, corruption, and destruction that drive them out. Could we not embargo their exports, most especially their exports of corrupt politicians, their family and their fortunes?

Always Follow The Money Trail

Clare Brown --the London-based environmentalist determined to expose Taib's corruption---has been able to shine a light on Taib's activities by pouring through the paper trail of investments. This, I think, is the key to discrediting any group. Thanks to Vivian Krause and Sun Media TV's persistence in showing the fraudulent nature of the David Suzuki Foundation's "charitable" status, Suzuki has been forced to distance himself from his own foundation. And the public is finally waking up to the corporate corruption of environmental groups. The Conservatives--to their credit--- seem determined to prevent green NGOs from taking donations from foreign-owned corporations. Our project, however, is to make the point that environmental NGOs should not be able to take money from ANY corporation, foreign or domestic. Shining a light on the big three (the DSF, the Sierra Club and Nature Conservancy ) and their practice of taking corporate money should be key to our effort to question their failure to address the profoundly negative impact of mass immigration---and their integrity. How does this smell: the Sierra Club of Western Canada has accepted money from the Rockefeller Brothers Fund (RFB) to protest the oil sands development and Enbridge pipelines. How interesting. Jay Rockefeller, a major donor to the RFB, is the long-time Governor and now senior Senator of West Virginia, one of the biggest coal-producing states in America, supplying coal for electricity generation to two dozen other states. According to Andrew Weaver of the University of Victoria, the burning of coal is 40 times more impactful than the burning of oil in terms of green house gas emissions, not to mention its medical effects. It seems that environmental groups are willing pawns of a corporate game that is less motivated by genuine concerns about the environment than deflecting attention from the damage they are doing in their own backyard. Shades of the East India Company, which supported Wilberforce's campaign to end slavery in order to undercut their chief rival in tea production---the West Indian slave plantations.

Scratch a noble cause and you find a mercenary motive.....

Green Inc. And “Green” Corporations---A Partnership Made In Hell

It is high time that the public come to understand that Green Inc. and the corporations that fund them are first and foremost a business. In return for the funding that maintains their paid bureaucracy and sustains their relentless quest for more and more donations, environmental NGOs give corporations what they crave---ecological dispensation, the seal of approval that they can wave on their websites and brochures as proof of their corporate "responsibility". Meanwhile, they can lobby for higher immigration quotas and aggressive outreach initiatives to recruit the foreign labour they want to fuel their drive to drill, mine and develop at an ever quickening pace----secure in the knowledge that they have bought the silence of their 'kept women' in the DSF and the Sierra Club and Nature Conservancy.

The Moral Stench Of Canada’s Growth Lobby

Canada is the Chicago of the 1920s writ large. It's bipartisan immigration policy is like a numbers racket where everyone from the cop on the beat to the politicians at City Hall get a "piece of the action". Environmental NGOs must be regarded as key constituents of the Growth Lobby, every bit as important to the team as are the slimy immigration lawyers, the cheap labour employers, the big banks, the Puppet Intelligentsia in academia and the CBC, which like the ethno-cultural organizations, feed off the taxpayer tit while they tirelessly work to undermine our country. Together they form a stew of putrid slime that has no equivalent except what one would see while peering through the hole of a outhouse. Next time you're in a Provincial Park and nature calls, take a whiff. That, my friend, is the foul stench of Canada's Immigration Industry---an industry that is fully complicit in the rape of Sarawak and regions like it across the world.

Tim Murray

May 4, 2012

We are being trapped by developers

Infilling and land-use planning in Victoria are simply forcible enclosures: "Enclosure involves more than land and fences, and implies more than simply privatization or takeover by the state. It is a compound process which affects nature and culture, home and market, production and consumption, germination and harvest, birth, sickness and death. It is a process to which no aspect of life or culture is immune. People too are enclosed as they are fitted into a new society where they must sell their labour, learn clock-time, and accustom themselves to a life of production and consumption; groups of people are redefined as "populations", quantifiable entities whose size must be adjusted to take pressure off resources required for the global economy. Women are enclosed by consigning them to the "unproductive" periphery of a framework of industrial work, which they can only enter by adopting "masculine" values and ways of being, thinking and operating. Skills, too, are enclosed, as are systems of knowledge associated with local stewardship of nature."

Infilling and land-use planning in Victoria are simply forcible enclosures: "Enclosure involves more than land and fences, and implies more than simply privatization or takeover by the state. It is a compound process which affects nature and culture, home and market, production and consumption, germination and harvest, birth, sickness and death. It is a process to which no aspect of life or culture is immune. People too are enclosed as they are fitted into a new society where they must sell their labour, learn clock-time, and accustom themselves to a life of production and consumption; groups of people are redefined as "populations", quantifiable entities whose size must be adjusted to take pressure off resources required for the global economy. Women are enclosed by consigning them to the "unproductive" periphery of a framework of industrial work, which they can only enter by adopting "masculine" values and ways of being, thinking and operating. Skills, too, are enclosed, as are systems of knowledge associated with local stewardship of nature."

Infilling and land-use planning create real and spiritual cages for us

"Because history's best known examples of enclosure involved the fencing in of common pasture, enclosure is often reduced to a synonym for "expropriation." But enclosure involves more than land and fences, and implies more than simply privatization or takeover by the state. It is a compound process which affects nature and culture, home and market, production and consumption, germination and harvest, birth, sickness and death. It is a process to which no aspect of life or culture is immune.

"The Oxford English Dictionary offers a general definition of enclosure — to "insert within a frame". Enclosure tears people and their lands, forests, crafts, technologies and cosmologies out of the cultural frame-work in which they are embedded and forces them into a new frame¬ work which reflects and reinforces the values and interests of newly dominant groups. Any pieces which will not fit into the new framework are devalued and discarded. In the modern age, the architecture of this new framework is determined by market forces, science, state and corporate bureaucracies, patriarchal forms of social organization, and ideologies of environmental and social management.

Land, for example, once it is integrated into a framework of fences, roads and property laws, is "disembedded" from local fabrics of selfreliance and redefined as "property" or "real estate". Forests are divided into rigidly defined precincts — mining concessions, logging concessions, wildlife corridors and national parks — and transformed from providers of water, game, wood and vegetables into scarce exploitable economic resources. Today they are on the point of being enclosed still further as the dominant industrial culture seeks to convert them into yet another set of components of the industrial system, redefining them as "sinks" to absorb industrial carbon dioxide and as pools of "biodiversity". Air is being enclosed as economists seek to transform it into a marketable "waste sink"; and genetic material by subjecting it to laws which convert it into the "intellectual property" of private interests.

People too are enclosed as they are fitted into a new society where they must sell their labour, learn clock-time, and accustom themselves to a life of production and consumption; groups of people are redefined as "populations", quantifiable entities whose size must be adjusted to take pressure off resources required for the global economy. Women are enclosed by consigning them to the "unproductive" periphery of a framework of industrial work, which they can only enter by adopting "masculine" values and ways of being, thinking and operating. Skills, too, are enclosed, as are systems of knowledge associated with local stewardship of nature."

Extract from The Ecologist Vol. 22, No. 4, July/August 1992, at http://www.theecologist.org/back_archive/19701999/

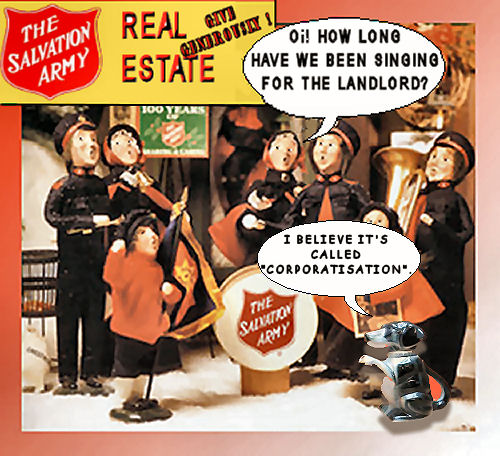

Salvos part of the problem now, it seems

Economically rationalised charity?

The Salvation Army has joined a growing list of faith-based community aid organisations that have jumped onto the urban development bandwagon at measurable expense to wider community interest. The Salvos have lodged an urban subdivision proposal upon a heritage site in the Brisbane suburb of Chelmer. An approval will result in demolition of the site's buildings and sale of the re-zoned land.

Maybe it's time for such entities to re-examine their strategic objectives.

Should they be attacking the root of the problems they ostensibly deal with, or is it OK to actively assist expansion of the disadvantage market?

Are they primarily a charity or are they an economic corporation focused on growth?

Warrina Village aged care Chelmer closes for subdivision Sat, 05/03/2011

An impact assessable subdivision application has been submitted for this site by the Salvation Army which includes demolition of existing buildings. A003019156

Warrina Village is an aged care facility at Chelmer owned and man-aged by the Salvation Army. The Salvation Army propose to relocate the facility to Chapel Hill and dispose of the site.

The site includes a 19th century two storey residence, originally known as Pontresina. Pontresina has cultural heritage values as a substantial 19th century villa and is entered on the City Plan Heritage Register.

The Salvation Army propose to demolish most buildings on the site and re-configure the lot (Lot 4 on RP 163091).

If you are financing a home, you will lose it - US trends

How long can Australia prop up a declining housing boom?

This film reports on a steep decline in land and housing prices in the US and predicts that they will fall further - by 70 or 80%. It says that if you are investing in a house or simply buying one now, you are going to lose the house because it will lose speculative value. It says that Americans with common sense are simply staying away from buying houses, knowing that they can bring the market to its knees this way. It says that the winners in this will be those who need houses and will soon be able to afford them. The losers - the land speculators; the people who have made money idly out of homelessness; the bankers, the middleclass housing investment wannabes - will lose their money. About time.

Actually, the film says that if you own a house you will lose it, however, if you really own one - just one - you won't lose it. If you are counting on a second or more houses to make you money, it is likely that they won't make what you hoped.

Australian governments, acting against the interests of their constituents, but on behalf of their corporate friends in finance, construction, engineering and property development have propped up the so-called 'boom' in housing with high immigration financed by your taxes, using the commercial media to sell the idea that this is all inevitable and good.

Growth spruikers are to blame

The populations of Queensland and Western Australia are being promoted as being expected to more than double within the next 50 years. Similar false predictions are being made in every other mainland state for shameless commercial interests masquerading as our elected representatives, aided and abetted by spruikers entrenched in many Australian institutions, acaademic ones not excepted.

For instance, Growth lobbyist and demographer, Peter McDonald of the Australian National University has made another press release in a long series of growthist apologies, "Population growth requires a balancing act: Expert Monday 31 May 2010", where he markets as irresistable the idea that the Queensland Government must consider an increase in taxes to manage future population growth, claiming this to be the finding of a new report. The report was commissioned by the Local Government Association of Queensland and claims to be independent, but its use of Peter McDonald has people concerned about population growth calling this claim into question, since McDonald is a notorious growth lobbyist.

Calling himself a "Population expert" and using the authority of his position as a professor at the ANU, Professor McDonald reports that "the inquiry has concluded that substantial future growth is already embedded in the state’s economy and that there appears to be little immediate prospect of current growth rates in Queensland - including those in south-east Queensland (SEQ) - slowing from current levels through reasonable policy initiatives available to the state or federal governments.”

Such a pronouncement conveys the false message that 'growth cannot be stopped' ... ever, and is likely to disarm the public of reasonable hope, empowerment and rational action against the growth lobby.

Talk of 'unreasonable costs' depends on the perspective you take.

Population Growth doesn't pay for itself: you pay for it

Problem is that the costs of growth are already causing unreasonable hardship to most people, by driving up the cost of water, land, employment, services, business, travel and basic utilities. The only people who don't consider the current situation unreasonable are those who benefit from it financially, and they are in the minority. Although they are in the minority, they are covered by the mainstream media as if they were in the majority and as if there were no other way of running a society than through heavy indebtedness to financial institutions invested in the construction and property development industries. It is amazing that so many people have fallen for this childish nonsense just because the mainstream press constantly repeats it and some 'authorities' endorse their message.

Growth can be stopped, quite reasonably and easily

Professor McDonald misinforms the Australian public to their great cost. Growth can be stopped, quite easily, using traditional tried and true methods. Amalgamated councils can control and withhold building permits. Better still, restore the recently abrogated ability for local governments to control the release of building permits. Allow the local community to set population levels by simply withholding building permits within the local water catchment capacity and within limits which will prevent further change to the natural environment and any rise in land-costs due to inflation related to human numbers.

Professor McDonald also said that the inquiry recognised community concerns about the pressures of continuing population growth and impacts on the quality of life. Recognises these concerns and tramples all over them!

He can be contacted at this number: 0400 252 149

To say that we cannot stop growth is like endorsing an addiction to growth and a mind-set like the Titanic heading towards the iceberg, with lemming on it that won't change the course!

If we are supposed to get more "prosperity" from population growth - in Queensland for instance - then why must the Queensland government consider more taxes? What we are seeing is a predictable rise in costs by increasing demand on finite resources - environmental and infrastructure-wise! This ever-soaring demand will spell disaster for Queenslanders' quality of life, standard of living and for its remaining wild koala populations, luxuriant vegetation and beautiful natural surroundings.

What kind of corruption and insanity, what hatred of beauty and life itself, drives this downward spiral for humankind in Australia, based on the insanity of economic growth based on population growth and endless construction?

Consider the US trends.

John-Paul Langbroek and why the Liberal National Party won't survive unless Labor Governments reform

The Queensland Liberal National Party leader, John-Paul Langbroek tried to restore some democracy in Queensland last week. Perhaps it is because his party can see that if democracy is not restored - by restraining the pursuit of the ALP's private financial power through government - no other political party may ever have a chance to govern again, simply because the ALP has become so rich and its power so far-reaching, and arguably it is less a government than a commercial corporation. Langbroek's reforming initiatives have taken two forms: 1. to call for a referendum into privatisation and 2. to submit a bill to make inquiries into corrupt systems and specific activities in Queensland. Predictably this bill was killed by the ALP on the 2nd reading.

The Queensland Liberal National Party leader, John-Paul Langbroek tried to restore some democracy in Queensland last week. Perhaps it is because his party can see that if democracy is not restored - by restraining the pursuit of the ALP's private financial power through government - no other political party may ever have a chance to govern again, simply because the ALP has become so rich and its power so far-reaching, and arguably it is less a government than a commercial corporation. Langbroek's reforming initiatives have taken two forms: 1. to call for a referendum into privatisation and 2. to submit a bill to make inquiries into corrupt systems and specific activities in Queensland. Predictably this bill was killed by the ALP on the 2nd reading.

See also"Anti-privatisation e-petition calls on Queensland government to resign"

LNP Leader should not give up trying to restore democracy to Queensland

The Queensland Liberal National Party leader, John-Paul Langbroek, has attempted to restore some democracy in Queensland over the past two months. Perhaps it was because his party can see that if democracy is not restored - by restraining the pursuit of the ALP's private financial power through government - no other political party may ever have a chance to govern in the foreseeable future, simply because the ALP has become so rich and its power so far-reaching, that arguably it is less a government than a commercial corporation.

Langbroek's example should be followed by other politicians and other States.

Reform needs to take place on at least two levels - reigning in corruption by legislating for transparency and to limit cronyism between government, political parties and private entities - and to engage the public more vigorously in their self-government - i.e. democracy. Greater engagement of citizens is imperative because this is the only power left in politics which may be capable of overcoming commercial corporate power which has now merged with a government whose only weakness is its estrangement from the actual electorate.

So far Langbroek's reforming activities in in this regard in parliament have taken two forms:

1. to call for a referendum on privatisation (see p.3143 of Hansard) i.e. public engagement in an issue it knows the public don't agree with the government on [1] and

2. to submit a bill to make specific inquiries into corrupt systems and activities in Queensland.

This bill was first read on 28 October 2009. It was voted down, not surprisingly, by the majority Labor government on 25 November 2009.

The bill was of extraordinary importance, but to understand it, you need to understand what has been going on with ALP finances. It was of extraordinary importance because it potentially affects the Federal government and potentially every state government. This is because of a massive blurring of boundaries between the ALP, government and business, at Federal and State level, notably involving Labor Holdings P/L, Labor Resources P/L, the Progressive Business organisation and the Advance Lobby Group, and various State Investment Companies, such as the Queensland State Investment company.

The Queensland Premier, Anna Bligh, has rightly accused the Liberal National Party of doing the same thing, i.e. having 'holding companies' where moneys coming in need not be called political donations because they are not going directly to the political party and can mingle with other earnings. So the argument, on the face of it, is the Wolf's when he is accused of eating little lambs. "Didn't you have roast lamb last Sunday yourselves? Why does that make me bad and you good?"

The problem is that this very big ALP wolf might eat all the sheep and leave none for anyone else, so it means that all the other wolves will have to start regulating their industry and cooperate with the lambs for the stability of the whole. Of course the wolves are the political parties and the lambs are the voters. The industry is politics and the problem seems to be that it has become confused with financial investment, notably in property assets and development.

All over the country, State parliaments are making laws to ensure that the interests of financiers and developers take precedence over those of the electorate.

Cliche's like, "We were elected to make hard decisions," do not justify the failure to consult the community.

Regulation of the industry means rigorously separating political parties from exploiting their positions in government for private sector or party profit. This is especially necessary if ALP financial interests - private, personal or party - have lead ALP governments to pursue unpopular policies and to make undemocratic laws in order to create an advantageous economic and regulatory climate for their members, friends and organisations. The reason that it is especially necessary is that the ALP is allegedly probably one of the richest political parties in the world and rules this land from coast to coast against mostly puny or unenthusiastic opposition parties.

Corruption, Cronyism and Unethical Behaviour Bill - details:

The Commissions of Inquiry (Corruption, Cronyism and Unethical Behaviour) Amendment Bill 2009 was a Bill for An Act to amend the Commissions of Inquiry Act 1950 by inserting new terms to have it inquire into corruption, cronyism and unethical behaviour. Its terms are particularly informative of problems in the Queensland Government, but the same processes and some of the same people and organisations seem to be involved in similar activities in other states. People should encourage Opposition politicians in other states to try to bring in similar bills.

Details from the bill

‘(7) The commission is to inquire into the following—

(a) the matters and circumstances that led to, and permitted to continue, the breakdown in integrity and incidences of misconduct in the public sector in relation to the payments received or sought by Mr Gordon Nuttall whilst a Minister, despite the Crime and Misconduct Act2001 and the bodies and powers created under it;

(b) the circumstances and procedures relating to all contracts of Queensland Government departments, or Queensland Government owned or controlled entities or appointments to Queensland Government boards or boards of Queensland Government owned or controlled entities in relation to which Mr Gordon Nuttall had Ministerial responsibility;

(c) the allegations made by Ms Jacqueline King that she and Mr Scott Zackeresen complained to the office of the former Premier, the Honourable Mr Peter Beattie, in 2002 about misconduct by Mr Gordon Nuttall, and the circumstances surrounding the cessation of their employment allegedly as a result;

(d) the circumstances that led to Sunsuper Pty Ltd, a superannuation fund with over $12 billion of funds under management, a substantial portion of which funds are the superannuation investments of Queenslanders, deciding to withdraw $100 million of the funds from the management of Queensland Investment Corporation and place those funds under the management of Trinity Property Trust (‘Trinity’), or a Trinity-related entity, and the coincidence of the payment by Trinity, or a Trinity-related entity, of $1m to Mr Ross Daley (or his company Veritate Pty Ltd), the then senior executive of the political lobbyist Enhance Group, and any other person;

(e) the dealings between Ministers, former Ministers, ministerial staff, former ministerial staff or persons exercising delegated authority on behalf of the Queensland Government, or Queensland Government owned or controlled entities, with lobbyists concerning access to government, the grant or withholding of approvals, the awarding of tenders, the entry into contracts and other decisions;

(f) the relationship between members of the Queensland Government and persons who have been appointed to the judiciary or magistracy by Labor Attorneys-General between 1998 and 2009;

(g) the termination of the employment of Mr Scott Patterson by the Labor Government and the failure of the Crime and Misconduct Commission to adequately address matters raised by Mr Patterson;

(h) the adequacy of the following legislation and government policies, with a view to advising on a coherent, uniform, consolidated and harmonised scheme for stipulating standards of conduct and supervising the integrity of government business in Queensland—

• Auditor-General Act 2009

• provisions of the Criminal Code dealing with

misconduct in public office

• Electoral Act 1992

• Financial Accountability Act 2009

• Charter of Fiscal Responsibility under the

Financial Accountability Act 2009

• Government Owned Corporations Act 1993

• Judicial Review Act 1991

• Local Government Act 1993

• Ombudsman Act 2001

• Police Service Administration Act 1990

• Public Sector Ethics Act 1994

• Public Service Act 2008

• Right to Information Act 2009

• Whistleblowers Protection Act 1994

• Witness Protection Act 2000

• Code of Conduct for Ministerial Staff under the

Public Sector Ethics Act 1994

• Codes of Conduct for Public Sector Entities under

the Public Sector Ethics Act 1994

• Code of Ethical Standards issued by the Members’

Ethics and Parliamentary Privileges Committee of

the Legislative Assembly of Queensland

• Queensland Contact with Lobbyists Code and the

Register of Lobbyists

• Ministers’ Code of Ethics published in the

Queensland Ministerial Handbook;

(i) any other matter raised with the commissioner during the commission of inquiry that the commissioner considers worthy of investigation for the purposes of the inquiry.’.

NOTES:

[1]

On 10 November in the Queensland Parliament Mr Langbroek said to Premier Bligh, "Last week the Premier admitted that her Labor government had spent $62.7 million on advertising in 2008. Given that the annual report of the Electoral Commission indicates that a referendum could be held for less than a quarter of that amount, will the Premier now hold a referendum on privatisations to give Queenslanders a chance to have their say, or is it the case that the Premier wants to be heard but refuses to listen?

Ms Bligh, the Premier of Queensland, responded by attacking the opposition for its past record of failing to oppose her government's privatisation. Bligh thus avoided dealing with the two substantial issues:

1. that the wide population does not support privatisation

2. that they were not asked by the government prior to the election because the issue was not put to them

3. that Mr Langbroek is asking for their opinion to be sought and empowered now via a referendum.

Mr Langbroek also asked Premier Bligh why surveys being distributed to householders still did not canvas citizens' views on privatisation.

"Mr LANGBROEK: My second question without notice is also to the Premier. I refer the Premier to the ‘Have your say’ surveys currently being distributed by Labor MPs in their electorates seeking community feedback. Given that the Premier and her Labor Party are spending $1.9 million of taxpayers’ funds to sell the privatisation agenda, will the Premier explain why her local MPs ask for feedback on 11 issues, none of which is privatisation?"

The Premier's response was that Mr Langbroek's party had prepared the way and that the government stand for "jobs" and that it was selling off assets to pay for "a modern Queensland with better services and better infrastructure."

In other words, she failed to answer the question, talked of a very vague mandate, and implied, by reiterating the government's usual justification of privatisation that the ends justify the means and the citizens have no say.

Bubble Economy 2.0: The financial recovery plan from Hell

Michael Hudson, argues that President Obama's 'recovery' plan will actually prevent recovery by diverting precious resources towards servicing debt thereby crowding out spending on goods and services. He argues that, instead, Obama should re-establish the practice of writing down of debts to reflect the debtor's ability to pay, restore the power of state attorneys general to bring financial fraud charges against the most egregious mortgage lenders, and for the re-establsihment of taxes on site-rental value, in order to discourage land speculation.

Michael Hudson, argues that President Obama's 'recovery' plan will actually prevent recovery by diverting precious resources towards servicing debt thereby crowding out spending on goods and services. He argues that, instead, Obama should re-establish the practice of writing down of debts to reflect the debtor's ability to pay, restore the power of state attorneys general to bring financial fraud charges against the most egregious mortgage lenders, and for the re-establsihment of taxes on site-rental value, in order to discourage land speculation.

Originally published on Global Research on 11 Feb 09.

Martin Wolf started off his Financial Times column today (February 11) with the bold question: "Has Barack Obama's presidency already failed?"[1] The stock market had a similar opinion, plunging 382 points. Having promised "change," Mr. Obama is giving us more Clinton-Bush via Robert Rubin's protégé, Tim Geithner. Tuesday's $2.5 trillion Financial Stabilization Plan to re-inflate the Bubble Economy is basically an extension of the Bush-Paulson giveaway - yet more Rubinomics for financial insiders in the emerging Wall Street trusts. The financial system is to be concentrated into a cartel of just a few giant conglomerates to act as the economy's central planners and resource allocators. This makes banks the big winners in the game of "chicken" they've been playing with Washington, a shakedown holding the economy hostage. "Give us what we want or we'll plunge the economy into financial crisis." Washington has given them $9 trillion so far, with promises now of another $2 trillion- and still counting.

A true reform - one designed to undo the systemic market distortions that led to the real estate bubble - would have set out to reverse the Clinton-Rubin repeal of the Glass-Steagall Act so as to prevent the corrupting conflicts of interest that have resulted in vertical trusts such as Citibank and Bank of America/Countrywide/Merrill Lynch. By unleashing these conglomerate grupos (to use the term popularized under Pinochet with Chicago Boy direction - a dress rehearsal of the mass financial bankruptcies they caused in Chile by the end of the 1970s) the Clinton administration enabled banks to merge with junk mortgage companies, junk-money managers, fictitious property appraisal companies, and law-evasion firms all designed to package debts to investors who trusted them enough to let them rake off enough commissions and capital gains to make their managers the world's highest-paid economic planners.

Today's economic collapse is the direct result of their planning philosophy. It actually was taught as "wealth creation" and still is, as supposedly more productive than the public regulation and oversight so detested by Wall Street and its Chicago School aficionados. The financial powerhouses created by this "free market" philosophy span the entire FIRE sector - finance, insurance and real estate, "financializing" housing and commercial property markets in ways guaranteed to make money by creating and selling debt. Mr. Obama's advisors are precisely those of the Clinton Administration who supported trustification of the FIRE sector. This is the broad deregulatory medium in which today's bad-debt disaster has been able to spread so much more rapidly than at any time since the 1920s.

The commercial banks have used their credit-creating power not to expand the production of goods and services or raise living standards but simply to inflate prices for real estate (making fortunes for their brokerage, property appraisal and insurance affiliates), stocks and bonds (making more fortunes for their investment bank subsidiaries), fine arts (whose demand is now essentially for trophies, degrading the idea of art accordingly) and other assets already in place.

The resulting dot.com and real estate bubbles were not inevitable, not economically necessary. They were financially engineered by the political deregulatory power acquired by banks corrupting Congress through campaign contributions and public relations "think tanks" (more in the character of Orwellian doublethink tanks) to promote the perverse fiction that Wall Street can be and indeed is automatically self-regulating. This is a travesty of Adam Smith's "Invisible Hand." This hand is better thought of as covert. The myth of "free markets" is now supposed to consist of governments withdrawing from planning and taxing wealth, so as to leave resource allocation and the economic surplus to bankers rather than elected public representatives. This is what classically is called oligarchy, not democracy.

This centralization of planning, debt creation and revenue-extracting power is defended as the alternative to Hayek's road to serfdom. But it is itself the road to debt peonage, a.k.a. the post-industrial economy or "Information Economy." The latter term is another euphemistic travesty in view of the kind of information the banking system has promoted in the junk accounting crafted by their accounting firms and tax lawyers (off-balance-sheet entities registered on offshore tax-avoidance islands), the AAA applause provided as "information" to investors by the bond-rating cartel, and indeed the national income and product accounts that depict the FIRE sector as being part of the "real" economy, not as an institutional wrapping of special interests and government-sanctioned privilege acting in an extractive rather than a productive way.

"Thanks for the bonuses," bankers in the United States and England testified this week before Congress and Parliament. "We'll keep the money, but rest assured that we are truly sorry for having to ask you for another few trillion dollars. At least you should remember our theme song: We are still better managers than the government, and the bulwark against government bureaucratic resource allocation." This is the ideological Big Lie sold by the Chicago School "free market" celebration of dismantling government power over finance, all defended by complex math rivaling that of nuclear physics that the financial sector is part of the "real" economy automatically producing a fair and equitable equilibrium.