The text printed below was originally printed as an appendix to the article About the Greek Civil War. That article was my response to the ABC Radio National program of 13 July 2011, "Greek Tragedy". - JS

Appendix: Transcript of "Greek Tragedy", 13 July 2100

ABC Europe correspondent [archival]: And with that the Speaker of the Greek Parliament, Filippos Petsalnikos, declared the vote passed 155 in favour, 138 against, the government winning the right to introduce tax rises for the lowest earners, to shed 150,000 jobs in the public service, and to cut salaries by 15%. Restaurant and café owners who were collecting 13% in GST will now have to add 23%, making the cost of a cup of coffee in Greece 10 percentage points more expensive overnight.

Keri Phillips: The Greek government is deeply in debt. Since the beginning of last year, the European Union and the International Monetary Fund have been negotiating with Greek political leaders -- agreeing to lend Greece enough money to keep repaying its debts, while forcing it to find ways to reduce its spending.

Hello, Keri Phillips here with Rear Vision -- on ABC Radio National, online and by podcast. Today we'll look at the origins of Greece's excessive national debt. How did this modern European nation of just over 11 million people come to owe over three hundred and thirty billion euro?

Although for much of the period before the recent global financial crisis Greece enjoyed respectable economic growth, you don't have to look far back to see a country ripped apart by international conflict and internal division. Greece fought the Italians and then the Germans during World War II and when the war ended in 1945, a bitter civil war between communists and anti-communists, ultimately won by the right, created social tensions that would last in Greece for the next 30 years. Dr David Close is a historian in the School of International Studies at Flinders University.

David Close: 1945 was Year Zero in Greece, like in much of Europe, because under the German occupation everything had been destroyed: the whole economic system, the physical infrastructure, the political system. The Germans had encouraged a growing civil war, as well, which got worse in the few years after the war. The driving force was a pro-soviet communist party, which grew very powerful under the German occupation, because it dominated the Resistance. And the opposing forces were backed first by the British and then by the Americans, and American backing enabled them to triumph in the end, so they won a decisive victory in 1949.

Keri Phillips: Yanis Varoufakis is a Greek economist from the University of Athens.

Yanis Varoufakis: By 1949 when the civil war ended, Greece was a divided nation, a nation in disrepair; an economy that had broken down completely after 15, 20 years of continuous warfare. A rural area that produced a massive exodus of migrants, many of whom ended up in Australia as our listeners already know. Yet in the early 1950s growth came to the country in the form of the ubiquitous Marshall Plan, which was a godsend. Not only did it stop starvation from spreading its tentacles throughout the country, but in addition to that, it created the circumstances that led to the development of nascent industry, industrial sector, which then proceeded in the 1960s to create circumstances that can lead the historian to describing Greece in the 1960s as a developing economy.

David Close: There was an economic miracle in Greece. It enjoyed the highest rates of economic growth in the western world for 25 years after the end of the civil war. And after about seven or eight years this growth became self-sustaining. It didn't depend on United States investment anymore.

Keri Phillips: What was going on in the society in an economic sense?

David Close: Industry grew enormously and much of the agricultural population migrated to cities, to higher productivity occupations in cities. The Greek-owned merchant fleet grew to be the largest in the world by 1970, so this was the era of Aristotle Onassis and Niarchos and others who in the end invested heavily in Greek industry. So those were just some of the components of growth. The pace of growth grew greatly under the military dictatorship of 1967 to 1974. The military dictatorship favoured big business, especially the ship-owners, and that was good for growth although bad for social equity.

Keri Phillips: A coup in 1967 had been followed by seven years of military rule. By 1974, when democracy was restored under the conservative New Democracy Party led by Constantine Karamanlis, the global oil shocks were already being felt by the Greek economy.

Yanis Varoufakis: When the oil crisis hit in '72, '73, the Greek economy realised, society realised to its consternation that the industrial miracle that had been built in the 1950s and 60s was so to speak built on sand, and with the first tremors of the international economy, the global crisis in the 1970s, it began to collapse. It was built on the basis of a clientalist relationship between an extremely authoritarian right wing regime that emerged from the civil war, with a very small number of well-to-do upper middle class families that were extremely well connected with the regime. On many occasions the same families had in their midst politicians and businessmen alternating between government posts and being captains of industry. The economy was protected from competition from the outside with large tariffs. It was the combination of the oil shock of the 1970s and the opening up of the Greek economy following the first stirrings of globalisation and, in particular, trade barriers were being lowered during a period that led to Greece's entry into the European Economic Community. So the industrial miracle of the '50s and '60s suddenly had to face up to the twin facts of increasing costs and increasing competition.

Keri Phillips: Almost immediately following the restoration of democracy in 1974, the New Democracy Government under Prime Minister Karamanlis had applied for membership of the European Economic Community -- the precursor to the European Union. Many in Greece saw membership as a means of protecting their fragile parliamentary democracy and encouraging economic development. But Yanis Varoufakis says that there was no way that Greek industry was going to be able to survive Greece's accession to the EEC in 1981.

Yanis Varoufakis: From 1976, 1977 onwards there was a frenzy of activity by panicking government to save the industrial sector that had been so painfully put together in the previous decades. There were a number of steps. One step involved in fact nationalisation of certain banks like the Commercial Bank of Greece, and also state subsidies, through those nationalised banks, of the industrial sector. The idea was that liquidity should be provided to the struggling industries to keep them alive, in order to come up with some ideas as to how they could be rendered competitive.

By the end of the 1970s, 1981 in particular, there was a change in government. The Socialist Party came to power with a program of large-scale nationalisations, but it never managed to put its program into action, simply because of the fact that they actually went bankrupt. So it had to take them over. It was not a question of putting in place their policy; they just inherited all these factories: textiles, even armaments factories that failed, and the government had to take them over and run them and finance them. So suddenly Greece, which had a very low public debt to GDP ratio, one of the lowest in Europe, suddenly started facing an increasing, escalating, accelerating debt problem.

Keri Phillips: Did the Greek government borrow the money to nationalise and keep those factories going?

Yanis Varoufakis: Indeed. And that lasted for about four or five years, during which the first socialist government, Pasok government, of Greece, between let's say 1981 and 1985-6 struggled to keep those factories alive. Unfortunately they did not introduce any serious management skills to these factories. They were being run on the basis of traditional featherbedding, favouritism, appointing their own party members and trade unionists on boards. It was a slow-motion accident unfolding in front of our eyes. First we had the private sector failure of the 1970s and then we had the public sector failure of the 1980s. And the result was the beginnings of the mess that Greece finds itself in today.

Keri Phillips: During the 1980s, the right wing governments of the New Democracy Party gave way to those of the Panhellenic Socialist Movement, better known as Pasok, under Andreas Papandreou. All those who had been on the losing side in the civil war, long excluded from both political power and economic participation, suddenly got a windfall.

David Close: Yes, that's right. All those associated with the losing side in the civil war had been excluded from power, and so when they mobilised politically and finally came to power themselves in the 1980s through the Pasok party led by Andreas Papandreou, that's the father of the present prime minister, they had a chance to make amends, to compensate themselves for their long years of exclusion. The result was that the public service grew to an extraordinary extent, regardless of financial consequences. Now this was a traditional feature of the Greek state, that it was too big and very inefficient and penetrated by political parties. This dates back to the origins of the Greek state in the early 19th century, but it had been greatly accentuated under the political right after the civil war, and then further accentuated by Papandreou's Pasok regime in the 1980s. Andreas Papandreou took it to unheard-of lengths. He increased the size of the public administration and the spoils system to a quite crazy degree. In about the six months before the general election of June 1989, for example, about 90,000 people were appointed to the public administration, with no reason and no qualifications. So while he was trying to introduce a welfare state, he was undermining the efficiency of the public service that was needed to make a welfare state effective. It was a contradictory policy which could only end in disaster.

Keri Phillips: What did these people do? What were they hired to do?

David Close: Good question. Read newspapers, chatted to each other, twiddled their thumbs. This was an everyday experience for visitors to government offices or any government institution in the 1980s, to see masses of idle people sitting around chatting to each other and treating the public as the enemy. The worst of it was that the public got lousy service, as well as having to pay through their taxes for all these useless people.

Keri Phillips: When the leftists did get in to power in the '80s did they find themselves already with a substantial deficit?

David Close: Only a small deficit. Strictly speaking the financial lunacy began in the late 1970s. The last time Greece ever had a government budget surplus was in 1976. And then after that two-party competition intensified. The conservative regime in its last years found itself under increasing threat from Pasok, and so spent up big to try to win an election. Then Pasok continued the trend after that in the 1980s. And so yes, Pasok by the mid-1980s had to accept very big loans from the European Union, or the European Economic Community as it then was, and then had to impose harsh austerity policies as a condition for receiving the loans. So the beginning of this cycle of crazy expenditure followed by harsh austerity policies can really be dated to the mid-1980s. In 1985 there were large-scale riots and strikes in protest against the government austerity policies, and these have continued periodically ever since.

Greek protesters [archival]: This country is ours. Not for foreign bankers. From today there is no democracy in Greece because the parliament vote a program against the people, against the constitution, against the interest of 95% of Greek society.

Keri Phillips: Yanis Varoufakis says that governments were not unaware of the need to try to rein in public spending:

Yanis Varoufakis: Greek governments up until 2004 have shown a degree of rationality and acumen, in the sense that when public finances seemed to be running out of kilter they would hit the brakes and introduce austerity and rein the debt back. It happened in the late 1970s, it also happened in the 1980s with the socialist government of Andreas Papandreou, the current prime minister's father. It then happened again in the 1990s when there was a very serious -- perhaps the only truly serious attempt -- to rein in the public debt problem and, at the same time, to modernise the economy. And it was this period in the 1990s that effectively transformed Greece and gave at least an impression of a Greece that was ready for the euro and a Greece that was ready for taking its rightful place next to its European partners.

By the -- if you remember -- the Olympics of 2004, there was even evidence of managerial competence within the public sector and within the private sector. The country managed to pull off a quite impressive Olympics. Unfortunately it was all financed by easy money being borrowed by the Greek state. When that private money burnt out during the great financial crisis of 2008, Greece found itself in a big black hole.

David Close: The problem was that during the years of prosperity, from the time when Greece joined the eurozone in 2002, credit became very cheap, which was a new experience in Greece. Greece had achieved the remarkable feat, hitherto, of growing more prosperous without the benefit of low interest rates. But the era of low interest rates began from about 2000, thanks to the accession to the eurozone. Whereas private households managed to resist the temptation to become too heavily debt -- levels of private household debt remained low by western European standards -- governments could not resist the temptation. Instead of trimming their expenditure they took full advantage of the cheap credit now available from French and German banks. And so they let levels of public debt remain extraordinarily high when they should have been using the economic good times to bring them down.

Keri Phillips: The spigot of cheap easy money was turned off in the credit squeeze of 2008 and the global financial crisis hit Greece's main industries -- shipping and tourism -- hard. By the beginning of 2010, Greek government debt was estimated at 216 billion euro. In Ireland, it was reckless lending by private banks to fuel a building boom that effectively destroyed their economy. It was a different story in Greece.

Yanis Varoufakis: In Greece the banks, however unlikeable they might be, did not cause the crisis. Indeed they were very conservative. They had not been exposed to the toxic waste like the German banks or the French banks had been. They were actually running a quite tight ship. The Greek banks' problem, and the reason why now they're bankrupt, is because the economy has collapsed around them. And all the loans that they had given to households and businesses turned into bad loans. And all the Greed government bonds that they had invested in are suddenly junk bonds. So you know what they say -- oh well actually what Tolstoy wrote in the first page of Anna Karenina, 'All happy families are alike, but unhappy families are unhappy in their different ways.'

So Ireland, Spain, Greece, there are different circumstances that led to our collective woes, but now we are in this situation and we are suffering from exactly the same ill-effects, even though our starting point was very different.

Keri Phillips: And looking at the debt that the government has, who is this money owed to?

Yanis Varoufakis: It's owed primarily to banks. The majority of that is owed to big banks. A very significant amount is owed to German and French banks. The problem that France has in particular is that French banks own two of those Greek banks which are themselves owed money by the Greek state. In addition to the banks there are pension funds, so the whole pension system in Greece is teetering on the verge of collapse as a result of its dependence on Greek government debt.

Keri Phillips: At the time of the global financial crisis, many countries found themselves having to take on extra debt, often, as in the UK, to save their banks. Why was Greece's debt such a problem? Professor Kevin Featherstone is director of the Hellenic Observatory, part of the European Institute at the London School of Economics.

Kevin Featherstone: The problem is whether Greece can sustain the repayments on this debt level. You're right though, Keri, that at an earlier stage, if we think of 2008, the very beginning of 2009, the level of public debt in Greece was not that different from that of several other member states. And also it was not that different to countries outside the eurozone such as the UK and the United States. What became problematic was the level of maturing debt that Greece had at a time when Greece was also running up a large deficit at the end of 2009. So it's rather like the consumer having a large mortgage with the bank - but then many other consumers have large mortgages with banks -- but this particular consumer also suddenly announcing that its credit card debts have suddenly exploded as well. And so the judgment of the financial markets, and in particular the credit rating agencies, was that Greece, with such high debts and also now suddenly such high deficits of the government, was in an unsustainable position.

Keri Phillips: Why does the rest of Europe care if Greece cannot continue to repay its debts?

Kevin Featherstone: Because it becomes a collective problem in the sense that the effects of Greece not being able to pay its loans would have very negative contagion effects right across the eurozone. And especially in the context of 2009 and 2010 the level of debt that Greece had that was owed to banks in Germany and France, was very high indeed. So you might say, Keri, that Greece was a problem, but also that, for the rest of the eurozone, and particularly the governments in Berlin and Paris, ultimately they were faced with the dilemma: you either bail out Greece or you bail out your own domestic banking systems.

Keri Phillips: So is it the case, then, that now banks such as the banks in France and Germany are lending Greece the money to repay those same banks?

Kevin Featherstone: It is governments and the IMF, the so-called troika, so that a loan is being provided to Greece to enable it to pay its creditors. And its creditors, yes, are banks in France and Germany etc. In parallel to this, what's being discussed at the moment, at German prompting, is some mechanism by which the banks of Germany and France could be encouraged, arms twisted, to accept less than the amount that they had loaned. In other words, the German government is keen that foreign banks who lent to Greece in a rather risky fashion on too easy terms, that they themselves should take some kind of hit. But at the moment these things are still being discussed and negotiated.

Keri Phillips: Can you give us some sense of how much money Greece actually owes? What's the debt of the Greek government?

Kevin Featherstone: In relative terms at the moment it's judged to be approximately 150 per cent of its gross domestic product. That means that the debt level is one and a half times all of the economic wealth and economic transactions taking place within Greece as a system. Now clearly 150 per cent is astronomical and the fear is that this debt level will actually increase and may rise as much as 200 per cent. In other words, it's Greece owing twice as much as Greece is actually worth in economic terms.

Keri Phillips: So is there any way that Greece could ever repay such a debt?

Kevin Featherstone: There is no way that a country could repay that amount of debt in the short and medium term. But then the task is less than that. The task is simply to keep up with the repayments on a long term basis. So it doesn't really matter to the rest of the euro system so long as Greece can continue to repay its maturing debts at particular points in time. The problem becomes if Greece at any particular point is spending too much, so that its current deficit is excessive. And that then raises the questions of Greece going bankrupt, not being able to afford to cover its maturing debt at any particular point in time. But just like you and I and countless listeners have large mortgages -- a large mortgage in itself is not problematic. What becomes problematic is if the individual payments at any particular point are not being covered. And it's in the interests of the eurozone that Greece gets to a point where it can afford that maturing debt.

Keri Phillips: As a member of the eurozone, Greece retains the right to control its own borrowing and spending but it cannot lower its own interest rates to stimulate its economy, nor can it devalue its currency to make its exports more attractive. Although in theory, governments can always increase taxes to raise money, in Greece the tax office is part of the bloated, inefficient and corrupt bureaucracy.

David Close: When tax departments are inefficient they find it easier to raise revenue from lower income groups than from the very wealthy. So any increase in taxation results in an increase in hardship for lower income groups -- which is one reason why we're having riots and strikes at this moment. The people that mostly pay the income tax are public employees whose income is known. Mind you, small businessmen get persecuted terribly. I have a brother who's a businessman in Greece, and he moans bitterly about persecution by the tax department. But I suppose that's because he can't hire expensive accountants and lawyers to deal with the tax department on his behalf. Large-scale business are much more successful in dealing with the tax department.

Yanis Varoufakis: The problem here is quite simple. The rich don't pay taxes. They find a way of avoiding it. And then the poor, feeling that it is quite a legitimate Olympic sport of sorts, try to avoid the taxman. So there is this highly dysfunctional relationship between the Greek state and the Greek citizenry. Of course the problem lies with the Greek state, because even in Australia, if you allowed people to get away without paying taxes, I suspect a very large number of them would do exactly that. So there is a chronic problem of underpayment of taxes, particularly by private sector entrepreneurs, who find ways of avoiding taxation. And then if you add to that the fact that Greece has a very high poverty ratio. The number of people who fall below the poverty line, even before the crisis began, was the highest in the eurozone. These people can't pay tax because they don't earn enough. And those who earn enough have ways, including off-shore companies, that allow them to avoid tax payments.

Keri Phillips: I guess it's impossible to know how much tax isn't being paid, but would it have been of a scale that could have made a difference to the situation Greece finds itself in now?

Yanis Varoufakis: I think so. I think it would have made a difference because there is a way of measuring it: you just compare the proportion of GDP that is collected by the taxman in Greece to the equivalent proportion in the rest of Europe, and it is about 40 per cent less. Having said that I have to add that if Greece had in the last 15 years shaped up, it would have got rid of the many malignancies that typify our social economy including tax evasion, but not just that: bureaucracy, corruption, lack of competitiveness and so on and so forth; these are real problems that the Greek economy has had for a very long time -- even if we'd managed to undo all those problems, Greece would still be in trouble now. It would not have been the first domino to fall in the eurozone. But it would have been the second or third or the fourth.

The reason why you are talking to me now is not because of the malignancies of the Greek state and the Greek social economy, it is because of the euro crisis. This crisis would have gone on and on even if Greece was a model citizen. Look at Ireland. Ireland did not have a problem with tax evasion. Ireland did not have a problem with a corrupt state. Ireland had one of the most dynamic corporate sectors in the world; it was the so-called Irish Tiger I believe it was called -- a nonexistent animal. And yet it finds itself in the dock, sitting next to Greece, being accused of bankruptcy. So the problem is systemic, it's got to do with the euro system, which was never designed to sustain the major shock of the great financial crisis of 2008.

Keri Phillips: And if you'd like to know more about the euro and the story of the eurozone, there's a program on the Special Features page on the Rear Vision website -- abc.net.au/rn/rear vision. You can also find programs about carbon tax and carbon emissions trading, if you'd like to see how these things have worked overseas. And if that's not enough, follow us on Twitter by searching for RNRearVision. The guests on Rear Vision today were Dr David Close from Flinders University, Professor Kevin Featherstone from the London School of Economics and Yanis Varoufakis from the University of Athens.

The Cold War shaped our history from the close of the Second World War. It was a power struggle between the United States and the USSR, which at one time engulfed the whole globe, in what may be termed ‘bi-polarity’ (i.e. a country has to either belong to one camp or the other.) Ever present was the threat of nuclear destruction and, for this reason, the Cold War never took on the proportions of open war.

The Cold War shaped our history from the close of the Second World War. It was a power struggle between the United States and the USSR, which at one time engulfed the whole globe, in what may be termed ‘bi-polarity’ (i.e. a country has to either belong to one camp or the other.) Ever present was the threat of nuclear destruction and, for this reason, the Cold War never took on the proportions of open war.

Seemingly, as a pychologically understandable response to the smearing of Russia by the corporate presstitute media, and now US President Donald Trump, many otherwise well-informed and insightful alternative journalists, who oppose the corporate newsmedia, find it necessary to defend the conduct of the dictator Josef Stalin (1878-1953) with spurious rationalisations.

Seemingly, as a pychologically understandable response to the smearing of Russia by the corporate presstitute media, and now US President Donald Trump, many otherwise well-informed and insightful alternative journalists, who oppose the corporate newsmedia, find it necessary to defend the conduct of the dictator Josef Stalin (1878-1953) with spurious rationalisations.

There is a popular argument against communism that accuses Soviet communists of murdering more people than the Nazis. This argument refers to the deaths that resulted from Joseph Stalin's orders. However, the argument fails when you try to find out which communists performed or agreed to Stalin's murderous purges. Because nearly all of the founding communists assumed to have been complicit in these mass murders were themselves murdered by Stalin during the purges.

There is a popular argument against communism that accuses Soviet communists of murdering more people than the Nazis. This argument refers to the deaths that resulted from Joseph Stalin's orders. However, the argument fails when you try to find out which communists performed or agreed to Stalin's murderous purges. Because nearly all of the founding communists assumed to have been complicit in these mass murders were themselves murdered by Stalin during the purges.

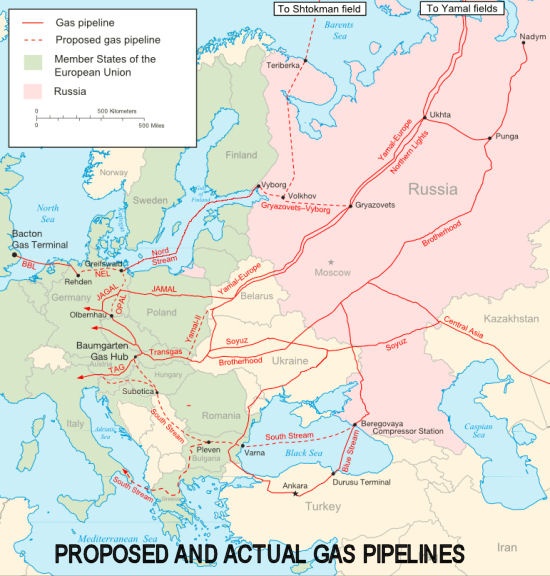

"The geology of the region itself as well as its position as a geographical gateway to the Middle East, explains wars in Afghanistan, Iraq, Libya, Syria, confusing dialogues with Iran and, now, moves on Ukraine. I really wonder if Australian politicians actually realise what they are backing in the region." Sheila Newman (Evolutionary sociologist specialised in oil geopolitics.)

"The geology of the region itself as well as its position as a geographical gateway to the Middle East, explains wars in Afghanistan, Iraq, Libya, Syria, confusing dialogues with Iran and, now, moves on Ukraine. I really wonder if Australian politicians actually realise what they are backing in the region." Sheila Newman (Evolutionary sociologist specialised in oil geopolitics.)

Recent comments