Can the current economic growth system be the basis for the Green Economy ? The current economies of western industrialised society are moribund and unable to provide the basis for the transition to the Green Economy without massive structural change. We need to scale down our expectations of financial prosperity having already attained a standard of living that is proving dangerous to our wellbeing.

Can the current economic growth system be the basis for the Green Economy ? The current economies of western industrialised society are moribund and unable to provide the basis for the transition to the Green Economy without massive structural change. We need to scale down our expectations of financial prosperity having already attained a standard of living that is proving dangerous to our wellbeing.

“Chinese rating agency Dagong, which has links to the government through its chairman, had downgraded the US's credit rating from A+ to A, with a negative outlook. Dagong has made a name for itself by hitting out at its three Western rivals - Moody's, Fitch and Standard & Poor's - saying they caused the financial crisis by failing to disclose risk properly. The big three agencies have consistently awarded Washington their highest possible "AAA" rating - allowing the US to take on more debt at lower cost. China, sitting on the world's biggest foreign exchange reserves of about $US3.2 trillion ($2.98 trillion) as of the end of June, is the largest holder of US Treasuries. Xinhua's comments came as China's central bank said it would continue to diversify its foreign currency investments, signalling growing concerns in Beijing over the US debt crisis and economic downturn.” Source: http://www.theage.com.au/business/world-business/china-to-limit-us-exposure-blasts-debt-bomb-20110803-1iarg.html#ixzz1Twp6jxWd

Neo-Libs try to wind back green initiatives

As we survey the wreckage of the 2008 global financial crisis and the complete lack of remedial action to avert a similar crisis, we are also faced with the imminent dilemma of not only the necessary transition to a green economy, but the advent of a reversal of green initiatives by a rampant neo liberal faction that bases itself on climate change denial.

This is witnessed by the current barrage of the winding back of environmental legislation now being pushed through US congress;

“We’re not looking at some modest cuts here and there – Congress is considering spending bills that could completely decimate government’s ability to regulate clean air and water, while turning clean energy programs into an afterthought.” http://thinkprogress.org/romm/2011/07/30/283648/the-most-anti-environment-house-in-history-how-is-your-representative-voting/

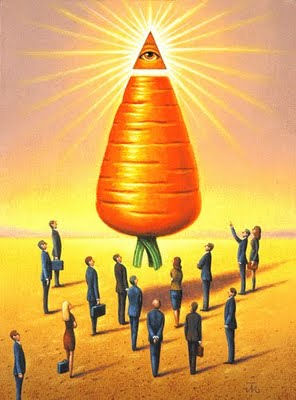

There is now a committed global group who have unlimited financial resources to travel the world spreading lies and misunderstandings to an eager audience who have found a comfort level in the last decade that they are unwilling to sacrifice.

Progress of spin

Ban Ki Moon’s frustration at the complete lack of direction within the UNFCCC, and attempts to formulate a regulatory process whereby the countries of the General Assembly would voluntarily agree to mandatory emissions reductions aimed at averting catastrophic climate change, forced him to re-orient the debate back to the basic formulation of the enabling document, Agenda 21, and Sustainable Development.

This document was the product of the 1992 Rio Earth Summit and set out the environmental and social agenda for the 21st century. It compromised 2 sections; protection of the earth’s atmosphere, and delivering those who were suffering abject poverty an equitable standard of living.

The bi-products of Agenda 21 were the UNFCCC and the Millennium Development Goals, neither are achieving their goals as we approach the 20th anniversary of the global commitment to fulfil these “promises”. We are given the “spin” that “progress is being made but we must do better”.

It is this papers position that if the “truth” be known, we are further away from the lofty goals of Agenda 21 now, than we were in 1992, having just witnessed the most greed inspired decade of self -indulgence, environmental degradation and waste that the planet has ever experienced. It has also been the hottest decade for temperatures ever recorded.

Each "age" adds something to the collective, but now we are collectively at a standstill, to the point where the sum of our "individual choices" has produced an economic, social and environmental disaster, bordering on collapse.

Potential societal collapse across triple bottom line: US debt-ceiling renegotiation

Only 10 years into the new millennium, we are faced with the potential societal collapse across the triple bottom line on an unprecedented scale, and now must regularly face a return to the collapse of the global financial system. The same financial system that many authors see as the “growth machine” that is the only vehicle that can make a transition to the green economy possible.

The recent farcical negotiations on the U.S. debt ceiling have proved the undoing, within many circles, of America’s status as a “superpower”, it is divided, has more per capita debt than Greece and no signs of a united determination to alter the greed or hubris of the richest 10%.

Profligacy measures for US Debt vs Austerity measures for Europe Debt

70% of the U.S. growth economy is dependent upon retail sales, in the country that has near terminal unemployment and a disappearing middle class, and bears witness to the practice of growth rate “revisionism” after the fact, which gives little or no optimism within its borders to foster the necessary confidence that the American people are being told the truth.

The European economy, the biggest economy in the world is, on the other hand, being forced through hoops and over hurdles to get loans that will see a prolonging of its “flat” economic growth. The problem there, being that the chronic debt that engulfs Europe, is further compounded by high unemployment, increasing debt levels and an endless regime of austerity.

Currently this “double dipping” left over from 2008, is forecast to take 10 years to overcome. This means that western industrialised society is not in a position to provide the stimulus to generate the Green Economy.

Ban Ki Moon's WESS fails the man in the street

The major omission from Ban Ki Moon’s "World Economic and Social Survey 2011" (WESS)[2] is the failure to consider the man in the street. WESS lays out the stark objective of “finding” $15-20 trillion to replace the current energy infrastructure in western society. This equates to “only” 2% of world GDP per year, but is this in a “good” year or a “bad” year?

His “success stories”, of the rapid transformation of Portugal’s renewable energy sector are in tatters as austerity measures rip the guts out of further advances, a fast train service between Lisbon and Madrid being the latest casualty. The Montreal Protocol is a sham, taking 24 years to ban a substance that has caused, (and will cause until the year 2050) untold damage to the atmosphere.

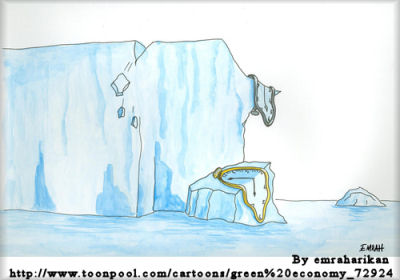

Capitalist growth cycle a voracious closed loop, now broken

The capitalist growth cycle is a voracious closed loop. Investment provides jobs which provide income for the man in the street to afford to buy goods which provide profits which are then re-invested to cause more environmental degradation to provide more jobs.

This cycle is now broken, and perhaps just in time.

The 2008 GFC broke that cycle. Until the damn wall broke, “consumers” had been fed an endless line of “Ponzi” credit based upon the escalation of the value of their homes. They felt rich to the point where household savings in the U.K. dropped into negative. As long as they were being told that this endless caravanserai would last forever the consumer maintained their part of the bargain and fed the capitalist cycle.

The housing default crisis put an end to that and proved that property bubbles were no cause for confidence in exponential growth, particularly in personal wealth. The individual is always at the bottom of the food chain, and is currently being positioned as the last person holding the parcel. In response to that, people have saved what money they have, which is why the economic growth model is currently broken.

Socialising of bank losses: Will the public be twice-duped?

The massive corporate and financial debts incurred by the banking system are being amortized amongst the millions, in what is now accepted as the socialising of loss. This is proving to be a flawed system response as it maintains the break in the consumer cycle and is a fundamental mistake being made by conservative governments worldwide who look to the same penalised people to regenerate their broken system by buying “stuff”.

It is impossible to see the population of Europe and America being “duped” twice. The citizens of many countries have taken to the streets to demonstrate their disgust at being made to pay the penalty for recklessness by others higher up the income ladder. So the question has to be asked will society ever return to the pre 2008 halcyon days of growth and hedonism?

Climate change science gives 39.5 years for world to make 50% CO2 emissions cut

There are 39.5 years left, as the science tells us, for the world population to make a 50% cut in global carbon emissions, to maintain temperature increases within the 2 degree limit above pre industrial times, the atmospheric carbon content target is set at 450ppm. In western industrial society this equates to minimum 75% emissions cuts in European countries, and 90-100% cuts in high polluting countries such as America and Australia.

Current “offers on the table” fall way short of that target, opening a pathway to temperature increases of up to 4 degrees above pre industrial levels with an atmospheric carbon content of anything up to 650 ppm. A change in climate that no scientific commentator would state can support life as we know it.

UN needs to embrace Degrowth Movement

That is at current population levels, however, there are projections that the global population will reach 9 billion people by 2050. This additional population is forecast to present in the “developing world” where climate change impacts and food security concerns are highest, prompting the WESS to project that another “true green” revolution in food production is also necessary.

The WESS states that the transition to a Green Economy has to happen within a 30 – 40 year time span. A global energy transition, even without an agricultural revolution within 30 to 40 years, is unprecedented in world history. The report clearly states that this must be driven by government and government regulation.

In making this “demand”, the report is severely lacking in tackling the real issue that pertains to the current attitude of the man/woman in the street, and similarly the attitude of corporate America, the generator of still unbelievable returns from the fossil fuel industry. It is only through these eyes that a sustainable future can be seen. The WESS also pays scant regard to alternatives to the existing growth paradigm and spends too little time discussing the very tangible limits to growth.

This issue has inspired writers who see this as an immediate problem ( Prof Tim Jackson,Prosperity without Growth, Economics for a Finite Planet, – new economics foundation - and inspired a “degrowth” movement in Europe. Non of the aforementioned would deny the technological benefits of growth to date, but the benefits of “novelty growth” (Jackson) must be called into question, and a system of growth based upon benefits to wellbeing introduced.

Having said all this we know that in the last 4 years global GDP has been at an average of 4%. A very “healthy” economic outcome generated by the growth in developing countries (the BRICS[1] nations and “tiger” economies) with the leader of course being China. China has also assisted some western countries such as Australia to avoid the worst outcomes of 2008 by importing the resources which Australia and others currently have in abundance.

An interesting aside to this is that the export bonanza has also allowed Australia to be in the sound financial position to introduce a carbon tax. Recent economic results however have given testimony to the “2 tier” economy that Australia now has, where although employment is at historical lows of 4%+, it is only through resource exports that the economy is profitable. The “service” economy that makes up a large part of the financial system is in decline as in other parts of western society. Australia suffered the same “disease” as the majority of western countries of “outsourcing” its manufacturing base to China and other parts of Asia.

Consequently it is the “BRICS” and “tiger” economies that are now driving global growth.

East is the factory, West is the failing service/financial sector, Green Economy a delusion

This is proving to be beneficial to another aspect of Agenda 21, - the Millennium Development Goals. The WESS stresses the need for global growth to encompass the developing world to alleviate embedded poverty. This is happening. It cites the 600 million in China who have been lifted from the $1.25 per day “income bracket”. However, the veracity of these claims cannot be justified in terms of the relativity with western levels of income at this stage.

China now struggles with inflation and massive environmental problems and the way it deals with this is crucial. After having captured the majority of global manufacturing China will have a massive impact on how the Green Economy evolves. There is no doubt that the pace of growth in China has completely disarmed the regulatory process to the point where the poorest are now prematurely suffering the unethical or downside of growth patterns.

Notwithstanding this, China is now outpacing the west in the race to the Green Economy even though it is still classified as a “developing country” albeit with the highest national emissions generation in the world.

We are now left with a 2 tier “global” economy, where the east is the factory and the west is the service/financial sector, albeit presently failed. Many reports have been written in western journals detailing how the Green Economy can be the saviour of the western world but this is delusional at best given the parlous state of debt levels already in existence and the necessity to “find” $15 – 20 trillion dollars to replace the west’s existing energy infrastructure.

The WESS is, along with its cursory discussion on limits to growth, also silent on the appearance of this new Green Economy which it is advocating by the year 2050.

What it does say on the “Green economy” is that a massive “technology transfer” to the developing world is necessary, and it is hard to see the required elevation in welfare within the developing world being maintained without massive education and job creation being a focal point of their development. .

Against growth in developed economies; for growth in the developing world

It is this papers argument that the developing world must maintain the bulk of global GDP growth. This is “inferred” in WESS but not specifically stated, it can only be through development within this sector that the necessary impetus can be attained for the Green Economy, and go anywhere near to fulfilling the Millennium Development Goals.

It is now time for the western world to bite the bullet, the dubious prospect of the masses returning to “the good old days” are fading with every unemployment reading, with every retail sales report, and with every GDP revision. It is now necessary to change the structure of society, successfully.

We are now witnessing the transformation of the “greatest financial crisis since the great depression” to the “greatest financial crisis” period. The remnants of western society are hopelessly equipped to deal with a financial system that no one has any confidence in. Those that caused the financial crisis are now advocating more of the same to get us out of the crisis, isn’t this Einsteins definition of madness?

The system does not have to crash before we accept it is beyond repair, what needs to be overcome is the right wing mantra of small government, government spending reductions and less taxation.

A regulatory system for the global financial sector must be introduced as it is the only “profitable” sector in the western economy. Ross Gelbspan has long advocated a quarter of a cent tax on each financial transaction as a way of delivering a green transition.

The false mantra that jobs, jobs, jobs, are the salvation of society must be tempered. Any “Green Economy” must impose limits to growth, which also means a corresponding limit to employment. The natural answer to this is re training and job sharing, as advocated by Jackson in Prosperity without Growth, Economics for a Finite Planet.

“There will be no more building booms in Spain”

Spain’s socialist heir apparent Alfredo Perez Rubalcaba has openly said there will be no more building booms in Spain, what is offered is training programmes to re- educate workers, hopefully in the Green Economy. Spain cannot rely on tourism and bullfighting to pull its economy out of the ruin, fortunately it is more advanced than many countries in the transition to renewable energy.

The world must scale down its expectations. It is no surprise that the only reduction in global emissions occurred during the global financial crisis. To induce this as an environmental panacea is wrong, but it gives a hint of the necessary transformation to a Green Economy. Whilst it may be economically blasphemous for pundits to advocate a Steady State Economy, the stability that this implies is exactly what is necessary at present in western industrialised society, as opposed to the roller coaster of (ir)rational economics.

In the interests of humanity, western society is “obliged” to acknowledge its historical part in the looming environmental crisis. We are obliged to scale down our expectations of financial prosperity having already attained a standard of living that is proving dangerous to our wellbeing. The speed and scale of the developing world’s transformation will bring its own realisation that the path it has embarked upon is flawed, just look at how the west messed it up. Human beings have the same urges, it doesn’t matter where they live.

Dick Cheney's mantra a basis for western societal collapse

Dick Cheney’s mantra that “the American way of life is non- negotiable” has to be realised for what it is, the basis for societal collapse. No-one wants that, one has to presume that even the debt ceiling negotiators realise that after the event. Barack Obama, has proved to be a tool of Wall Street which has also now been accepted as great driver of the 2008 collapse, the basis of economic growth is now as unstable as recession, promising only “business as usual” which Ban Ki Moon discredits very early in the WESS.

It is now time to stop the exponential growth and concentrate on things that matter as human beings, think about the stability that a Steady State Economy implies, and work toward implementing the Green Economy with what we can salvage from our prosperity to date.

NOTES

[1] “BRICS nations”: In economics, BRIC is a grouping acronym that refers to the countries of Brazil, Russia, India and China, which are all deemed to be at a similar stage of newly advanced economic development (Source of definition wikipedia) The group also includes South Africa.

[2] "World Economic and Social Survey 2011" (WESS)

About the WESS: "World Economic Situation and Prospects (WESP) is a joint product of the Department of Economic and Social Affairs, the United Nations Conference on Trade and Development and the five United Nations regional commissions. It provides an overview of recent global economic performance and short-term prospects for the world economy and of some key global economic policy and development issues. One of its purposes is to serve as a point of reference for discussions on economic, social and related issues taking place in various United Nations entities during the year.

World Economic Situation and Prospects 2011

WESP 2011

After a year of fragile and uneven recovery, global economic growth started to decelerate on a broad front in mid-2010 and this slower growth is expected to continue into 2011 and 2012. The United Nations baseline forecast for the growth of world gross product (WGP) is 3.1 per cent for 2011 and 3.5 per cent for 2012, which is below the 3.6 per cent estimated for 2010 and the pre-crisis pace of global growth.

Weaknesses in major developed economies continue to drag the global recovery and pose risks for world economic stability in the coming years.

The unprecedented scale of the policy measures taken by Governments during the early stage of the crisis has no doubt helped stabilize financial markets and jump-start a recovery. However, overcoming the structural problems that led to the crisis—and those that were created by it—is proving much more challenging and will be a lengthy process. This contrasts with the strong GDP growth in many developing countries and economies in transition, which has contributed more than half of the total expansion of the world economy since the third quarter of 2009.

The report highlights the continued challenge posed by high unemployment rates in many economies and outlines a number of risks and uncertainties for the economic outlook such as a premature withdrawal of policy stimulus, increased exchange rate volatility and a renewed widening of global imbalances. Against this background, several policy challenges are discussed in greater detail, including the optimal design of fiscal policies as well as the coordination between fiscal and monetary policies, the provision of sufficient support to developing countries in addressing the fallout from the crisis and the coordination of policy measures at the international level." (Source of this review was the UN Development Policy and Analysis Division.)

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

The decline in the value of the US dollar is engineered by the US government in order to make US products more affordable and to relaunch their manufacturing economy. The world is trapped by the US into subsidising its debt on account of the very large market it represents and the control over the money markets of US corporate investors. Other economies with higher value currency will experience a falling off in sales because the goods they produce will be less affordable on the world market. Hans-Peter Martin and Harald Schuman wrote about this 'trap' late last century. Read what they wrote then and consider how well it explains our current situation.

Can the current economic growth system be the basis for the Green Economy ? The current economies of western industrialised society are moribund and unable to provide the basis for the transition to the Green Economy without massive structural change. We need to scale down our expectations of financial prosperity having already attained a standard of living that is proving dangerous to our wellbeing.

Can the current economic growth system be the basis for the Green Economy ? The current economies of western industrialised society are moribund and unable to provide the basis for the transition to the Green Economy without massive structural change. We need to scale down our expectations of financial prosperity having already attained a standard of living that is proving dangerous to our wellbeing.

Recent comments